The pitch deck is often a résumé for conformity.

Most founders ask how to fit in before asking if the game is worth playing. The system selects those who adapt to its template, not those who challenge its premise.

A pitch deck is rarely just a presentation. In practice, it often becomes a test of alignment with norms that were designed not for innovation, but for predictability. Slide by slide, the venture is formatted to be palatable, legible, and safe. Terms like “total addressable market,” “competitive moat,” and “go-to-market strategy” are not inherently flawed—they can be useful tools when thoughtfully applied. But in most decks, they serve less as genuine reflections of a founder’s strategy and more as ritual signifiers, included not because they are necessary, but because they are expected. Their presence signals fluency in a code written by incumbents, not pioneers. The issue is not their existence, but their unexamined repetition—how quickly they become shorthand for credibility, and how rarely their relevance is questioned.

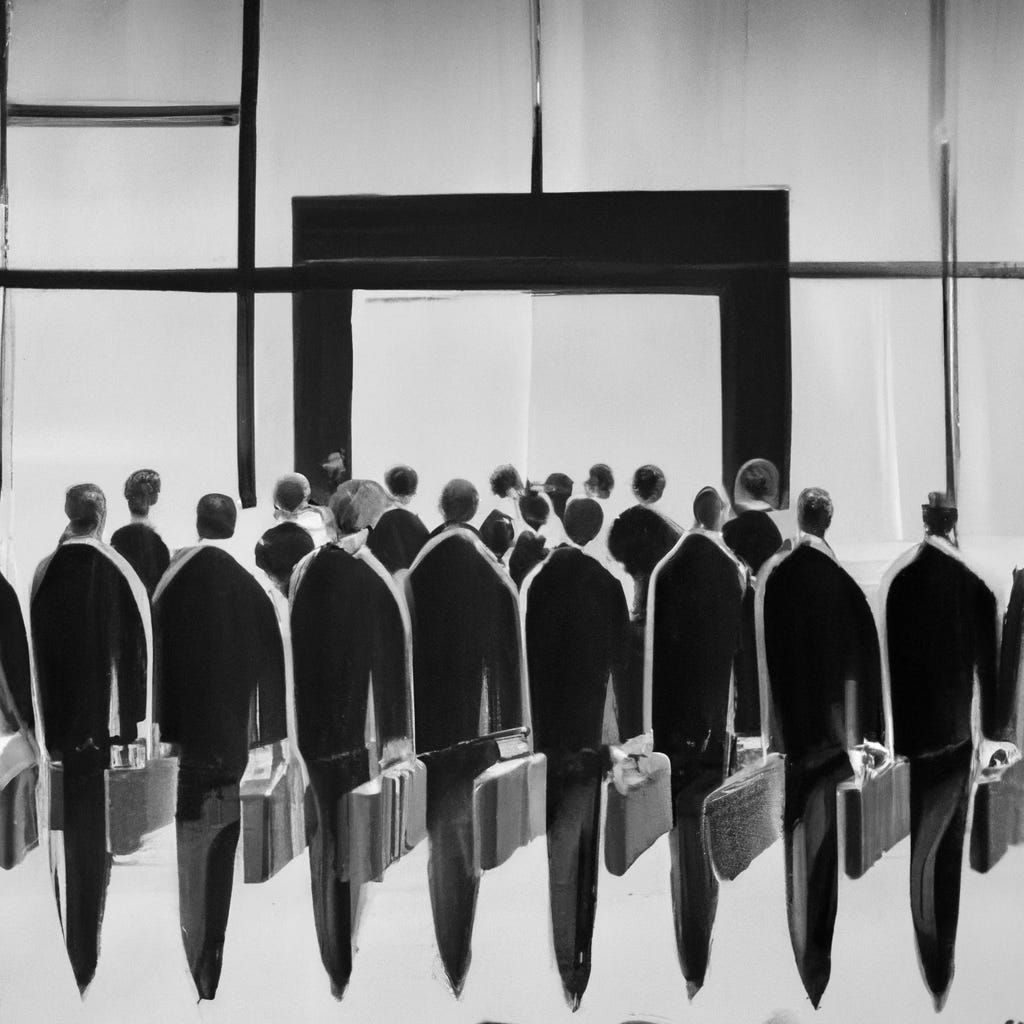

In most rooms, the pitch is not a dialogue. It is a ritual. It rewards compression, imitation, and consensus. Founders tailor their ambitions to match investor expectations, optimizing for what is fundable, not for what is necessary. Originality is tolerated only if it wears a familiar costume. The result is a pipeline of ideas that look different on the surface but conform to the same underlying expectations of scale, speed, and simplification. The truly new—those who move beyond category, who refuse to frame their work in pre-approved language—are often filtered out before the conversation begins.

This dynamic selects for talent that conforms, not transforms. Founders learn to hide their edge, to prioritize clarity over complexity, and to perform certainty where doubt is the more honest signal of depth. It creates a paradox: the very individuals most capable of advancing civilization are taught to diminish themselves in order to be accepted by the mechanisms designed to fund advancement.

But perhaps this is not a bug. Systems are built to preserve themselves. If the dominant order is optimized for risk-adjusted returns, it will favor the predictable over the exceptional, the incremental over the existential. This is not a critique of investors—it is a structural reality. Still, clarity emerges: those who seek to do what has never been done must be willing to bypass the processes that only reward what has been proven.

In a world where capital flows toward familiarity, the hardest task is not to get noticed—it is to remain intact. Integrity is not just moral; it is structural. The pressure to dilute vision for validation is relentless. Few resist. But the future does not belong to the optimized. It belongs to those who refuse the tradeoff between radical thought and access. This does not mean rejecting all structure or refusing all capital. It means recognizing the cost of fitting in. It means building the thing that does not yet have a slide template. It means understanding that in most rooms, the greatest danger is not rejection—it is being accepted for the wrong reasons.

What if the pitch deck is not the starting point? What if the work speaks first, and the capital comes later—or not at all? What if the measure of seriousness is not how closely a founder matches the fund’s thesis, but how far their vision challenges the need for one? To build something that changes everything, one must first unlearn the desire to be understood by everyone. The truly transformative is often illegible—until it is undeniable.