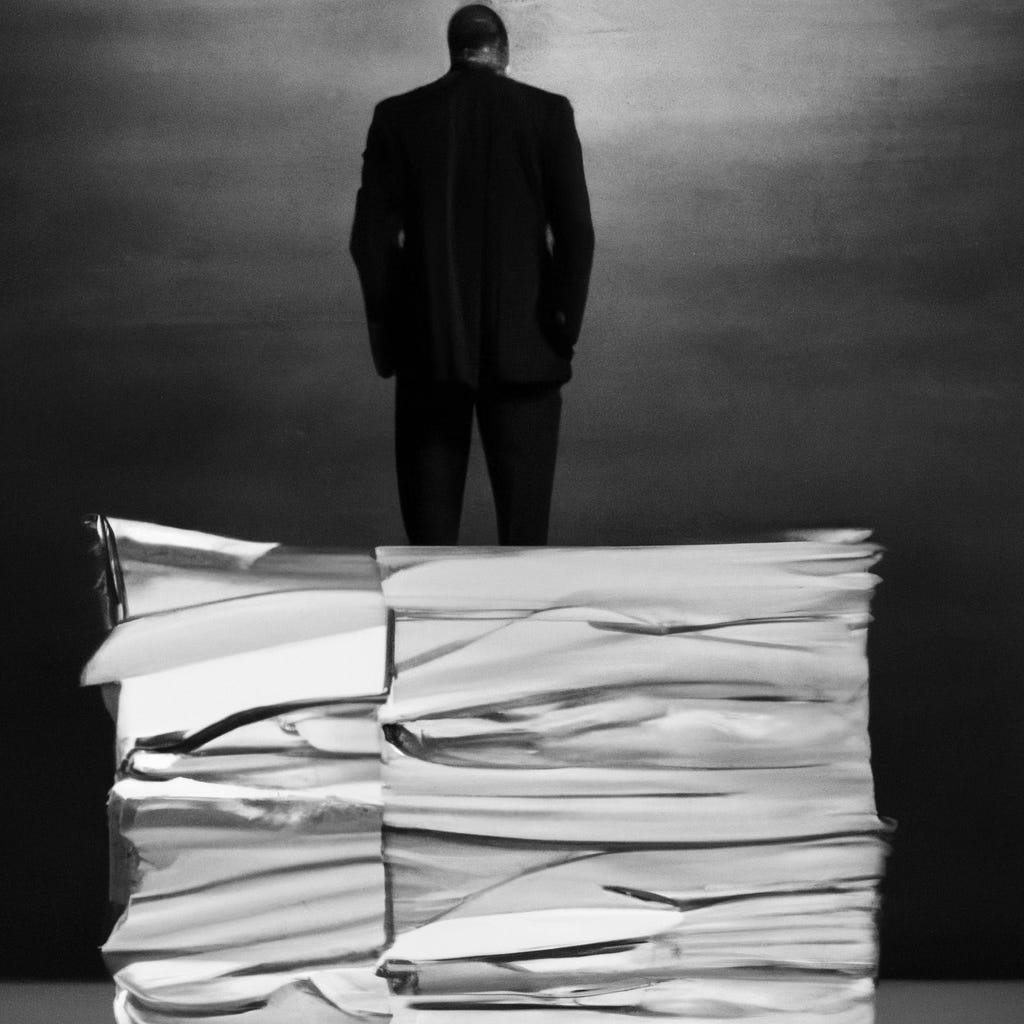

Pricing reveals courage more than spreadsheets.

Pricing is a declaration of value, not a calculation. The chosen number exposes conviction.

Pricing is often framed as a technical exercise: benchmarks, elasticity curves, competitive grids, and carefully modeled scenarios. These tools are useful, but they are not decisive. At the moment a price is set, the real question is not analytical but existential. It asks whether an organization trusts its own judgment enough to stand by the value it claims to create, even when that stance invites resistance.

Low pricing is frequently justified as prudence. In practice, it often reflects fear: fear of rejection, fear of comparison, fear of being forced to defend one’s own standards. When prices are anchored primarily to competitors or market averages, the organization quietly admits that it does not lead value creation but reacts to it. The constraint is not intellectual capacity, but decision-making conviction.

High pricing, by contrast, is not arrogance when it is grounded in substance. It is a declaration that value is not discovered through consensus but asserted through clarity. Setting a demanding price forces coherence across the entire system: product quality, delivery discipline, customer selection, internal talent, and long-term vision. Weakness is punished immediately. There is no room for vague promises or symbolic differentiation.

Markets do not reward comfort. They reward those who can endure tension without diluting themselves. Pricing at the edge of what feels defensible creates productive pressure. It compels the organization to grow into its own claims rather than hide behind incremental positioning. In this sense, price is not just a revenue mechanism; it is a mechanism of self-selection. It filters customers, partners, and even employees according to seriousness.

There is also a moral dimension often ignored. Underpricing transfers risk inward while exporting indecision outward. Over time, this erodes internal standards and external trust. Clear pricing, even when contested, respects the intelligence of the market. It invites dialogue instead of manipulation. It states, without theatrics, what the organization believes its work is worth.

The most resilient organizations are not those with the most refined models, but those willing to accept the consequences of their convictions. They understand that value is not proven first and priced later. It is defined first, defended second, and refined continuously under real pressure. Pricing, then, becomes a test of maturity. It reveals whether an organization seeks approval or seeks alignment. Whether it optimizes for safety or for becoming something stronger than it currently is. Spreadsheets can inform the decision, but only courage completes it.