Investing in people is the best way to future-proof a portfolio.

A portfolio built on short-term gains is fragile. Sustainable growth requires investment in individuals who redefine limits and create new opportunities.

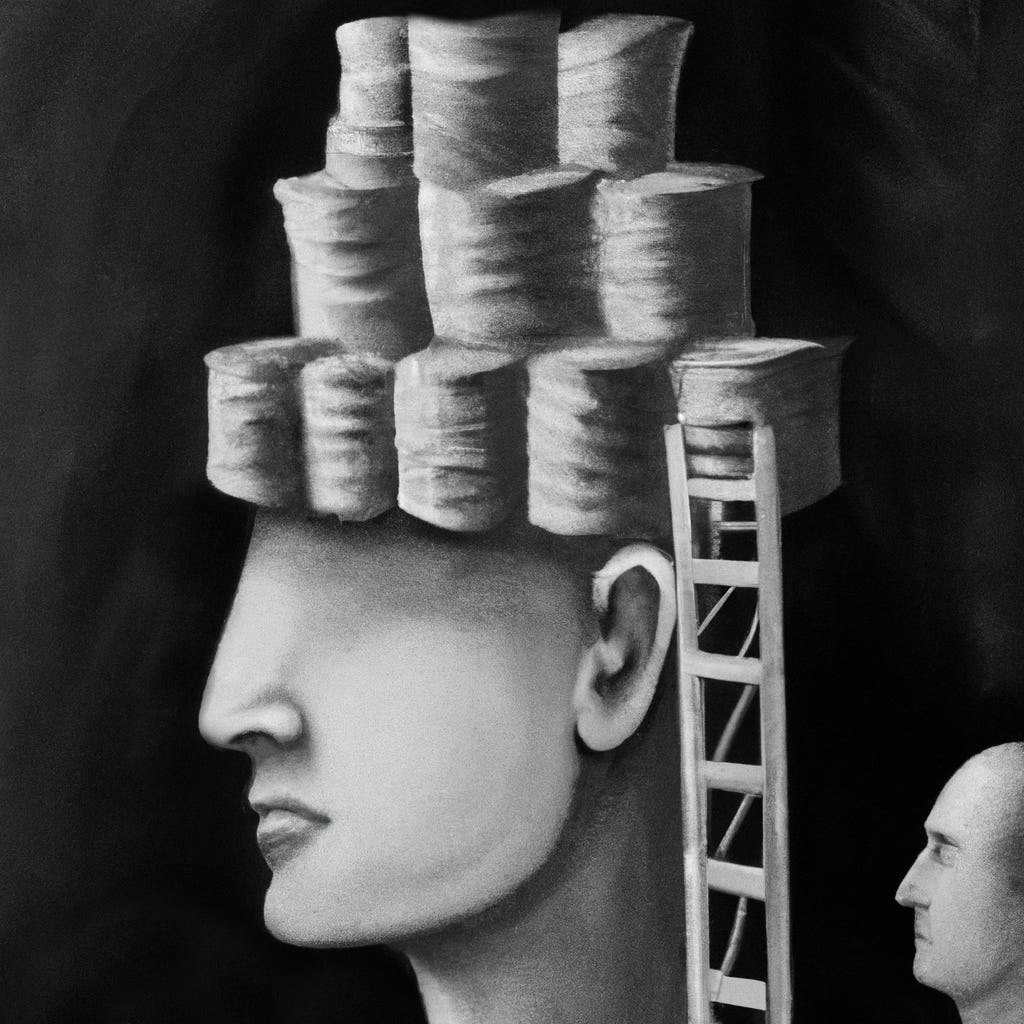

The foundation of any long-term strategy is the capacity for adaptation. Market trends shift, technology evolves, and external disruptions emerge without warning. In such an environment, the only stable asset is human potential—specifically, those who do not merely follow established paths but create new ones. Investing in individuals who challenge conventional wisdom, question limitations, and actively expand their own capabilities yields a compounding effect that no traditional asset class can match.

Capital allocation often prioritizes innovation in infrastructure, technology, and data analytics. Yet, these are only tools. The real leverage lies in the minds that design and use them. Organizations that seek sustained dominance understand that competitive advantage is not found in static efficiencies but in dynamic thinkers who recognize opportunities others overlook. The highest returns come from those who continuously push beyond their existing skill sets, reconstruct their mental frameworks, and remain unburdened by outdated assumptions.

Risk management, a core principle of investment strategy, is often viewed through the lens of asset diversification and hedging mechanisms. However, the greatest hedge against volatility is not diversification—it is resilience. This is not a passive trait but an active capacity to redefine one’s approach in response to evolving realities. Those who internalize this mindset do not merely endure change; they dictate its direction. Investing in such individuals is not an expense but a structural advantage that compounds over time, reinforcing itself through continuous iteration.

The challenge lies in recognizing these individuals before their impact becomes widely acknowledged. Traditional markers of competence—academic credentials, years of experience, or adherence to industry best practices—are insufficient. The most valuable individuals are not those who optimize within existing frameworks but those who redefine them. Their key trait is not expertise in a given field but an ability to extract unconventional insights, discard obsolete methodologies, and reconstruct new paradigms from first principles. Identifying this capacity requires a shift in evaluation metrics, prioritizing demonstrated adaptability, intellectual rigor, and a proactive drive to challenge the status quo over conventional indicators of past performance.

Investment strategies that fail to prioritize this element remain fundamentally constrained by external conditions. When market dynamics change, their structural limitations are exposed. In contrast, portfolios centered on individuals with a capacity for reinvention remain antifragile—benefiting from disorder rather than merely surviving it. These individuals do not react to volatility; they capitalize on it.