In impact investing, the greatest return is not capital—it is consequence.

Financial returns satisfy expectations; consequential ones reset them. Some exits return capital—others return civilization to itself.

Impact investing is often spoken about in financial terms—risk mitigation, blended returns, long-term value. But when evaluated through this lens alone, something essential is lost. The essence of impact is not in numbers, but in the chain reactions that cannot be measured, only observed: in the irreversible shift of mindset, in the acceleration of progress at the margins, in the refusal to allow existing systems to define the limits of what can be done. The logic of capital can support transformation, but it cannot contain it.

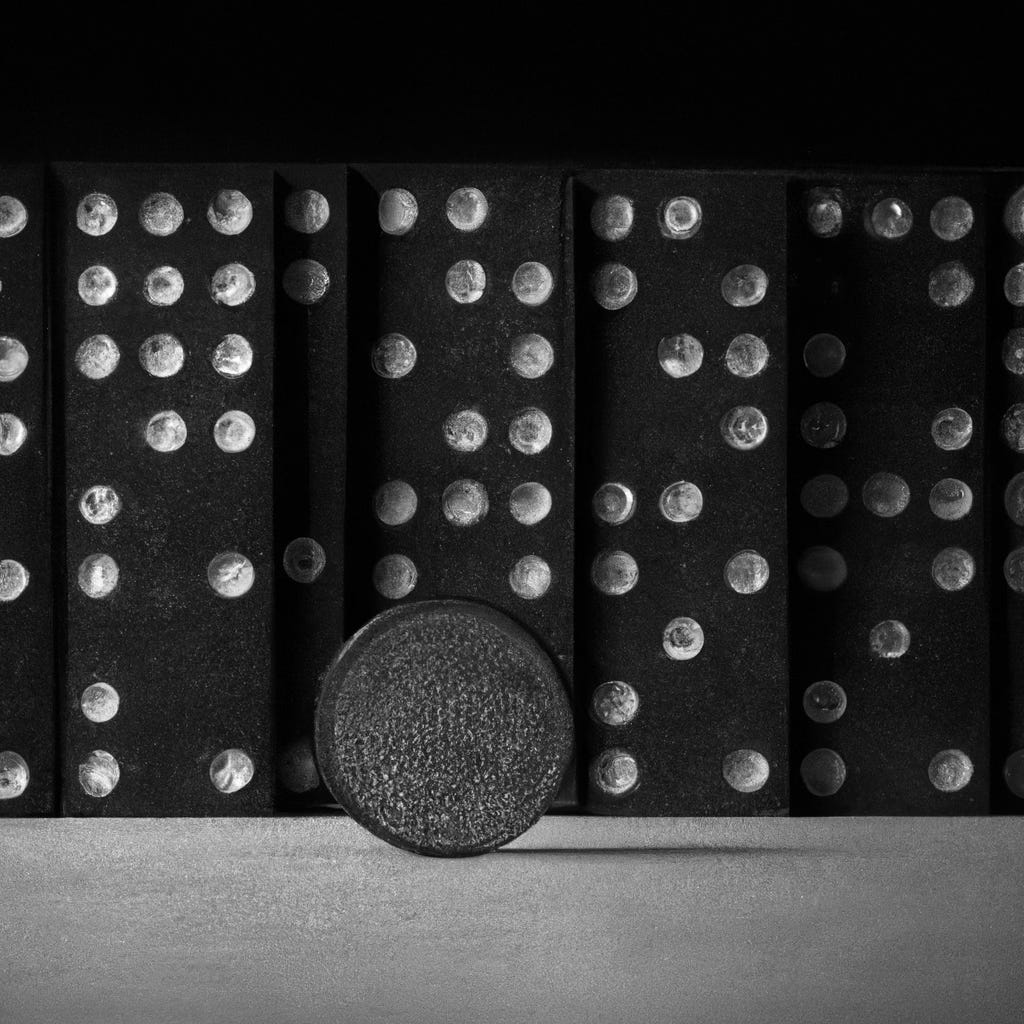

Where traditional investing evaluates ventures by the shape of their profit curves, impact investing—at its most serious—must focus on the shape of consequences. Some initiatives yield negligible financial returns yet trigger disproportionate change. Not all consequences are scalable, nor do they need to be. A single act of defiance in one country can ripple into systemic reform elsewhere. One product that empowers its user may provoke a wave of imitation, competition, and eventually a shift in the status quo. None of this fits neatly into spreadsheets.

The true frontier of impact lies not in correcting the system, but in bypassing it. Impact capital must stop thinking like charity with KPIs. Its highest use is not alleviation but realignment—connecting resources with those building what the current order cannot imagine. This requires a different kind of due diligence: not just asking whether the model is sustainable, but whether it is necessary. Not asking whether it will grow, but whether it should exist in the first place—and what ripple effects it might unleash once set in motion.

The most overlooked metric in impact investing is the individual. Ideas do not move the world forward—individuals do. And yet entire sectors are optimized to fund ideas without ever asking whether the founders behind them are wired to challenge reality itself. The real leverage is not in the product, but in the person: their defiance, their intent, their capacity for deviation from norms. Investing in the rare individual—especially one working without institutional backing—is often dismissed as risky. But this is the precise place where consequence is born.

To prioritize consequence is not to ignore capital. It is to subordinate it to something more exacting. A financial return satisfies a requirement. A consequential return challenges one. The highest yield from impact investing is not the exit—it is the entrance into a different paradigm. Once a new standard of what’s possible is seen, it cannot be unseen. This is why consequence matters more than growth. Growth returns capital. Consequence returns vision.

The rarest investments are not those that succeed within the system. They are those that escape it. And in that escape, they signal to others that such escape is possible. This is the real return: not merely to fund solutions, but to fund sovereignty—to accelerate those who choose not to wait for the system to change, but those who initiate the chain reactions that ultimately compel the system to transform.